Elevate Your Banking Experience With Credit Report Unions

Credit rating unions, with their focus on member-centric services and neighborhood participation, offer an engaging option to standard financial. By focusing on private demands and fostering a sense of belonging within their membership base, credit rating unions have actually sculpted out a niche that resonates with those looking for a more customized technique to handling their finances.

Benefits of Cooperative Credit Union

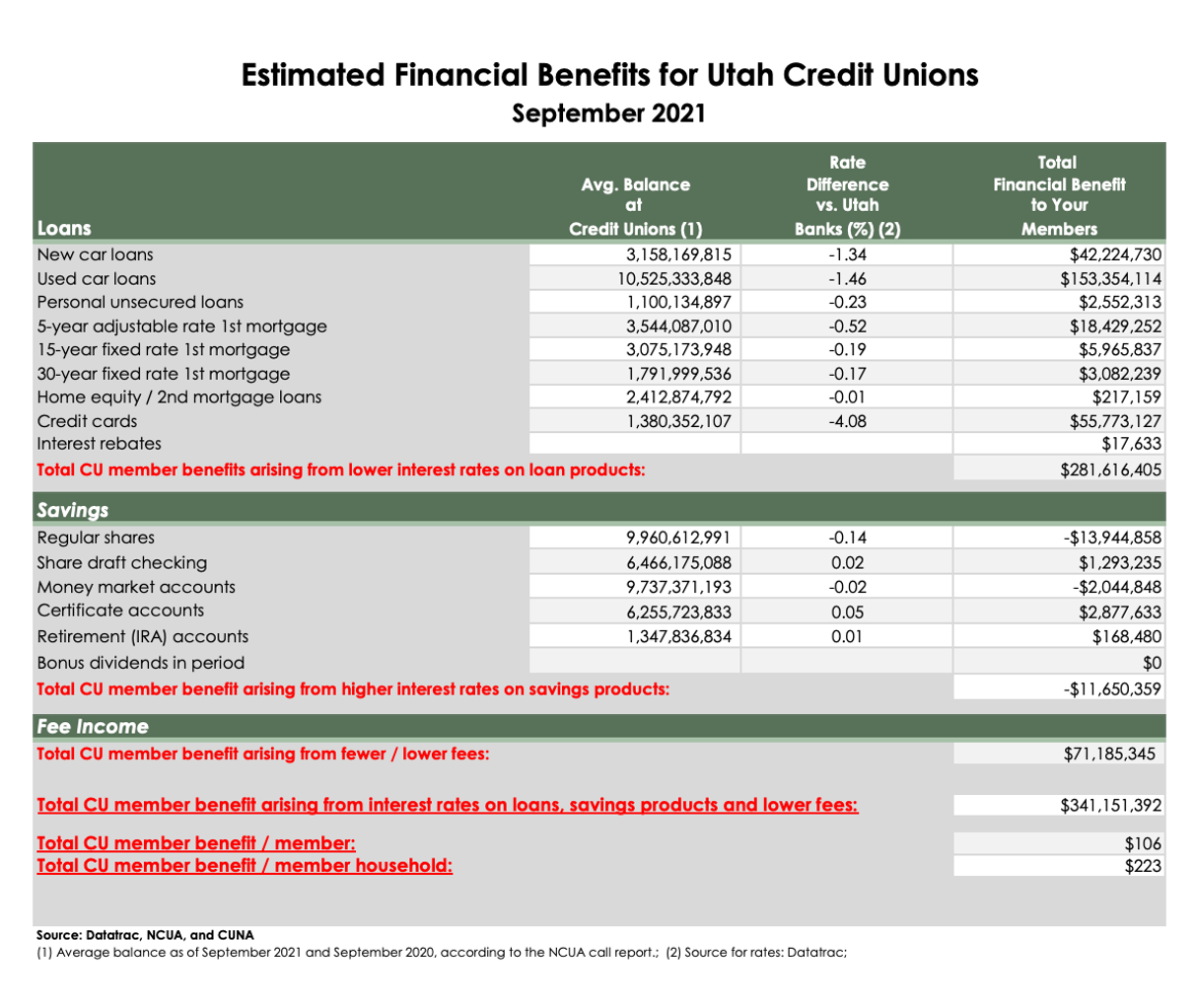

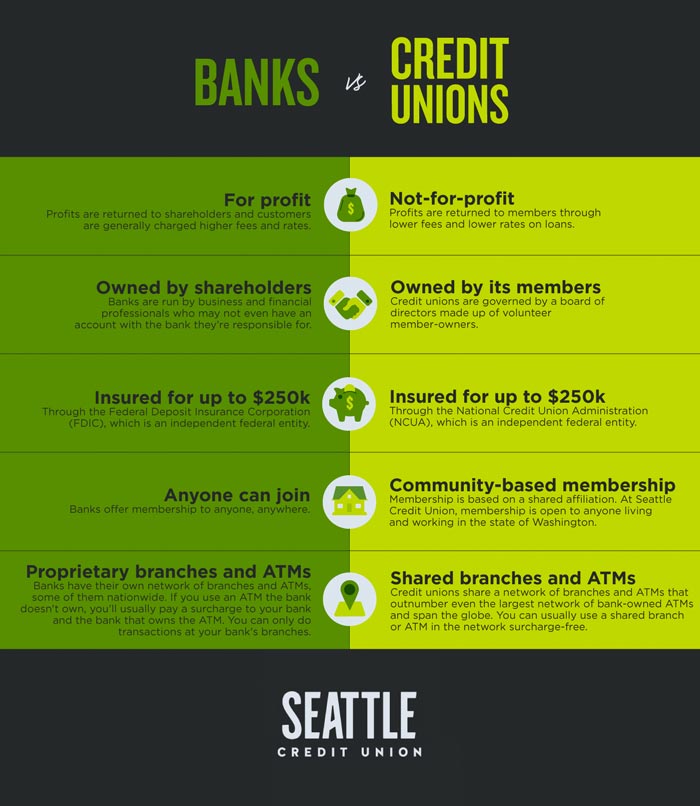

Offering a series of monetary solutions customized to the demands of their participants, lending institution supply many advantages that set them in addition to conventional banks. One key benefit of cooperative credit union is their concentrate on neighborhood involvement and member satisfaction. Unlike banks, cooperative credit union are not-for-profit organizations possessed by their members, which typically results in decrease charges and better rate of interest on interest-bearing accounts, lendings, and bank card. In addition, credit report unions are understood for their customized client service, with employee putting in the time to recognize the special financial objectives and challenges of each member.

One more benefit of debt unions is their autonomous framework, where each participant has an equivalent vote in electing the board of supervisors. Debt unions often supply economic education and counseling to aid participants improve their monetary proficiency and make notified decisions about their money.

Subscription Demands

Credit rating unions generally have particular criteria that people should fulfill in order to enter and access their economic services. Membership requirements for lending institution often include eligibility based on elements such as a person's location, company, organizational associations, or other qualifying partnerships. Some credit report unions may offer individuals who live or work in a specific geographical area, while others might be connected with specific business, unions, or organizations - Credit Unions Cheyenne WY. In addition, member of the family of present cooperative credit union members are usually qualified to join as well.

To become a participant of a cooperative credit union, individuals are normally required to open an account and maintain a minimum down payment as specified by the institution. Sometimes, there may be one-time subscription charges or recurring subscription charges. As soon as the subscription criteria are fulfilled, people can delight in the advantages of coming from a credit history union, consisting of accessibility to personalized financial solutions, affordable rate of interest, and a focus on participant complete satisfaction.

Personalized Financial Services

Individualized financial solutions customized to individual needs and preferences are a trademark of lending institution' commitment to member complete satisfaction. Unlike typical financial institutions that commonly use one-size-fits-all remedies, lending institution take an extra tailored strategy to handling their members' financial resources. By understanding the unique objectives and scenarios of each participant, credit report unions can supply tailored referrals on savings, financial investments, finances, and other economic products.

Cooperative credit union prioritize constructing strong partnerships with their participants, which permits them to use customized solutions that go past just the numbers. Whether a person is saving for a certain goal, preparing for retired life, or looking to enhance their credit report, cooperative credit union can create tailored monetary plans to assist participants achieve their goals.

Furthermore, credit rating unions normally offer reduced charges and affordable interest rates on financings and financial savings accounts, better enhancing the individualized financial solutions they provide. Cheyenne Credit Unions. By concentrating on specific demands and delivering tailored solutions, lending institution set themselves apart as trusted monetary partners devoted to aiding participants grow monetarily

Area Involvement and Support

Community engagement is a cornerstone of lending institution' objective, showing their commitment to supporting neighborhood campaigns and fostering significant links. Credit history unions proactively join area occasions, enroller local charities, and organize financial literacy programs to educate non-members and participants alike. By spending in the neighborhoods they serve, cooperative credit union not only strengthen their partnerships however also Federal Credit Union add to the total wellness of society.

Sustaining local business is one more way credit scores unions show their dedication to regional communities. Via offering bank loan and economic guidance, credit report unions assist entrepreneurs prosper and stimulate financial growth in the location. This support exceeds simply economic help; lending institution commonly offer mentorship and networking chances to help small companies prosper.

In addition, lending institution frequently participate in volunteer work, urging their employees and members to provide back via various community solution tasks. Whether it's getting involved in local clean-up events or arranging food drives, lending institution play an energetic function in boosting the lifestyle for those in need. By focusing on neighborhood involvement and support, credit history unions really embody the spirit of participation and common help.

Online Banking and Mobile Applications

Mobile applications offered by lending institution even more improve the banking experience by supplying extra flexibility and accessibility. Members can perform different banking tasks on the move, such as depositing checks by taking an image, getting account alerts, and even contacting client support directly with the app. The security of these mobile apps is a leading priority, with functions like biometric authentication and security protocols to guard delicate information. In general, credit scores unions' electronic banking and mobile apps equip members to handle their finances successfully and firmly in today's fast-paced digital world.

Verdict

In verdict, credit report unions offer an unique financial experience that prioritizes neighborhood participation, customized service, and member satisfaction. With reduced fees, affordable passion prices, and tailored monetary solutions, credit unions provide to private needs and promote economic wellness.

Unlike financial institutions, credit score unions are not-for-profit organizations possessed by their members, which commonly leads to reduce fees and much better passion rates on financial savings accounts, finances, and credit report cards. Additionally, credit score unions are known for their personalized consumer solution, with personnel participants taking the time to recognize the one-of-a-kind economic goals and challenges of each member.